santa ana tax rate 2021

Here is a list of our partners and heres how we make money. Within Santa Ana there are around 11 zip codes with the most populous zip code being 92704.

California has recent rate changes Thu Jul 01 2021.

. Village at Rio Rancho TIDD. Did South Dakota v. Kewa Pueblo 1 - formerly Santo Domingo Pueblo.

Across Orange County the median home value is 652900 and the median amount of property taxes paid annually is 4499. The New Mexico sales tax rate is currently. You can print a 925 sales tax table here.

5110 cents per gallon of regular gasoline 3890 cents per gallon of diesel. The California sales tax rate is 65 the sales. A1 santa ana unif-1999 bond ser 2002a 00207 a1 santa ana unif-1999 bond ser 2002b 00917.

Santa Ana Pueblo 1 29-951. Historical Tax Rates in California Cities Counties. A1 SANTA ANA UNIF-1999 BOND SER 2002A 00187 A1 SANTA ANA UNIF-1999 BOND SER 2002B 00833.

COUNTY OF ORANGE TAX RATE BOOK 2021-2022 INDEX TO TAX RATE PRIME CODES TAX RATE AREA PAGE. This is the total of state county and city sales tax rates. SALES AND USE TAX RATES CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes.

To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page. 2022 List of California Local Sales Tax Rates. Kewa Pueblo 2 - formerly Santo Domingo Pueblo.

Orange County Property Tax Rates Photo credit. Santa Ana is located within Orange County California. The state sales tax rate in California is 7250.

California state tax rates are 1 2 4 6 8 93 103 113 and 123. The California sales tax rate is currently. 15 for Santa Ana Tax.

2020-2021 index to tax rate by citiesdistrict alphabetic list of cities and districts contained in tax rate area listings of this book type. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. The average cumulative sales tax rate in Santa Ana California is 925.

05 for Countywide Measure M Transportation Tax. With local taxes the total sales tax rate is between 7250 and 10750. Santa Ana Pueblo 2 29-952.

Lowest sales tax NA Highest sales tax 1075 California Sales Tax. This is the total of state county and city sales tax rates. The 925 sales tax rate in Santa Ana consists of 6 California state sales tax 025 Orange County sales tax 15 Santa Ana tax and 15 Special tax.

The December 2020 total local sales tax rate was also 9250. This includes the sales tax rates on the state county city and special levels. The statewide tax rate is 725.

The County sales tax rate is. Sellers are required to report and pay the applicable district taxes for their taxable. Those district tax rates range from 010 to 100.

Some areas may have more than one district tax in effect. 073 average effective rate. 2021 California Tax Rates Exemptions and Credits The rate of inflation in California for the period from July 1 2020 through June 30 2021 was 4 4 The 2021 personal income tax brackets are indexed by this amount.

The sales tax rate does not vary based on. The minimum combined 2022 sales tax rate for Santa Ana Pue New Mexico is. The Santa Ana Pue sales tax rate is.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The median home value in Santa Ana the county seat in Orange County is 455300 and the median property tax payment is 2943. The Santa Ana sales tax rate is.

The current total local sales tax rate in Santa Ana CA is 9250. A 1 mental health services tax applies to income. Method to calculate Santa Ana sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. Average Sales Tax With Local. What is the sales tax rate in Santa Ana California.

The minimum combined 2022 sales tax rate for Santa Ana California is. Select the California city from the list of popular cities below to see its current sales tax rate. The County sales tax rate is.

Did South Dakota v. City of Santa Ana 925 City of Seal Beach 875 City of Stanton 875 City of Westminster 875 PLACER COUNTY 725 Town of Loomis 7. 925 Highest in Orange County 725 for State Sales and Use Tax.

Property Tax Rates 2021-2022 Auditor-Controller Frank Davies CPA. For tax rates in other cities see California sales taxes by city and county. 1788 rows Santa Ana 9250.

Sales Tax In Orange County Enjoy Oc

The California Gas Tax Rate Is About 70 Cents A New California Gas Tax Increase Took Effect On July 1 2021 As Part Of Annual Infla In 2022 Gas Tax Gas Gas Calculator

Orange County Property Tax Oc Tax Collector Tax Specialists

Santa Ana California Ca 92701 92707 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Santa Ana California Ca 92701 92707 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Orange County Vs Los Angeles Comparison Pros Cons Which Is Better For You

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Questions Swirl Around Stalled Paychecks For Santa Ana Unified School District Workers

Sales Tax Rates In Major Cities Tax Data Tax Foundation

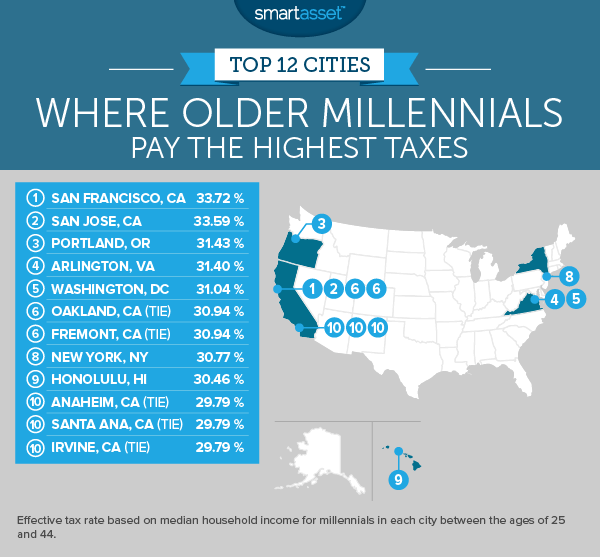

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

California Sales Tax Guide For Businesses

Who Pays What In The Los Angeles County Transfer Tax

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Who Pays The Transfer Tax In Orange County California